Malaysia now ranks among the world’s leaders in eWallet and QR payment adoption. Over five years ago, QR payments were initially met with hesitation by many Malaysians. Today, they’ve become one of the most common ways to pay, driven by a coordinated push from both public and private sectors.

In 2019, there were only around 300,000 retailers accepting QR payments in Malaysia. By 2024, that number has grown to over 2.6 million retailers, with electronic payments (ePayments) transactions surging from 3.6 billion to 14.7 billion.

Driving this shift is a combination of government policy, fintech innovation, and strong momentum on the ground. We recently gained more insights during a sharing session by the Ministry of Domestic Trade and Cost of Living (KPDN) and TNG Digital, organised during Expo 2025 in Osaka, Japan.

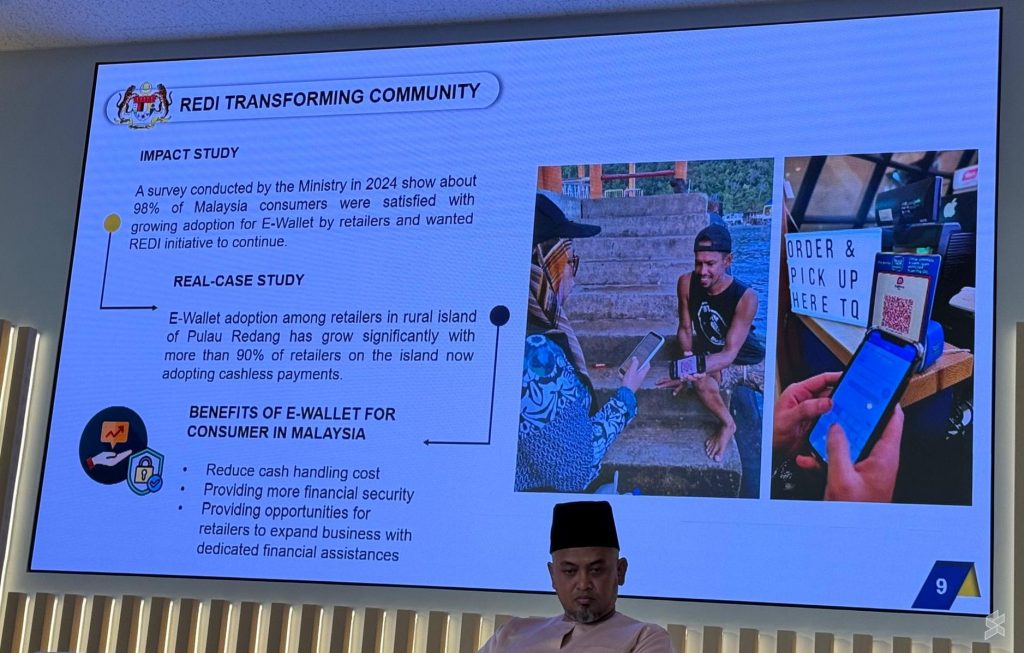

One of the main efforts by the government is the Retail Digitalisation Initiative (ReDI) which started in April 2021 by KPDN. The objective was to create awareness of the benefits of digital transactions and to promote a cashless ecosystem nationwide, especially in rural areas.

The digitalisation initiatives which include onboarding of retailers were also supported by strategic partners including Touch ‘n Go eWallet (TNG eWallet).

Of course, the pandemic did play a role in accelerating QR adoption as consumers and merchants turned to contactless payment options for safety and hygiene reasons.

Touch ‘n Go eWallet is the largest eWallet player in Malaysia

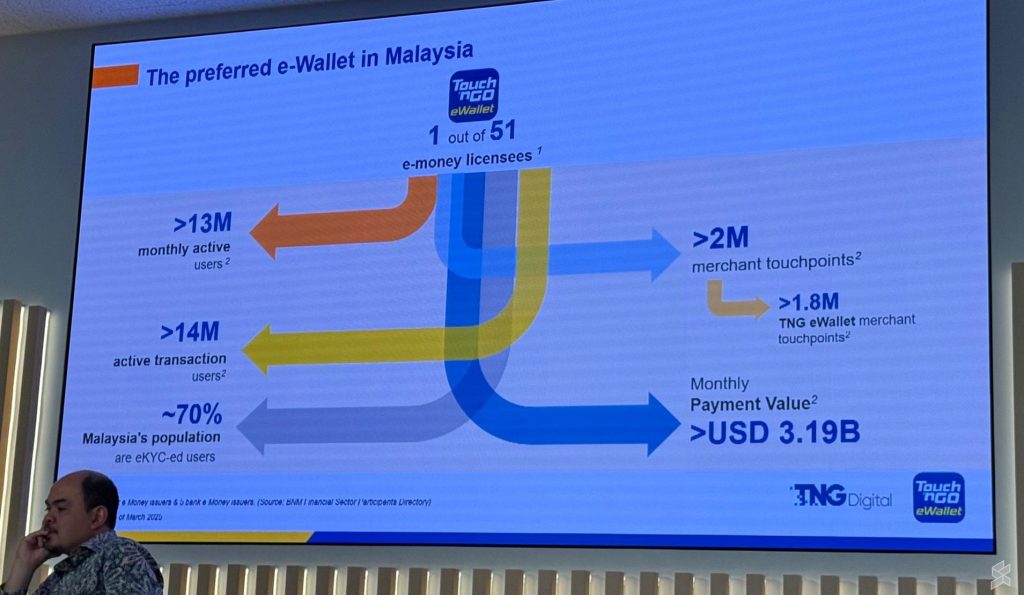

TNG eWallet is one of 51 approved eMoney licensees in Malaysia, and it remains the biggest player in the market. As of 2024, it has over 20 million verified (eKYC-ed) users and more than 13 million monthly active users.

The platform supports over 2 million merchants, with transaction volumes exceeding RM15 billion every month.

Interoperability between domestic and international eWallets has also been a game-changer. As a major participant in the DuitNow QR ecosystem, Malaysia’s national QR standard, TNG eWallet has helped simplify payment acceptance for merchants.

With just one DuitNow QR code, businesses can accept payments from any major eWallet or bank app. TNG eWallet currently accounts for 38% of all DuitNow QR acquisitions, and contributes 45% of DuitNow-based government-to-government cross-border transactions.

On top of that, TNG eWallet is also part of the Alipay+ network, allowing merchants to accept cashless payments from international tourists including mainland China.

eWallet adoption gets a massive boost from government eWallet subsidies

QR payment adoption has also gotten a significant boost thanks to government-led subsidy programmes. Since 2020, the government has disbursed over RM2 billion through six national eWallet subsidy schemes, including ePenjana, eBelia, ePemula, and eBelia Rahmah.

TNG eWallet has been a key supporter in all six programmes and saw the highest user uptake, accounting to 85% of all claims under the government-led eWallet subsidy schemes. These large-scale rollouts introduced digital payments to millions of first-time users and has encouraged merchants to accept QR payments in order to benefit from the subsidy programmes.

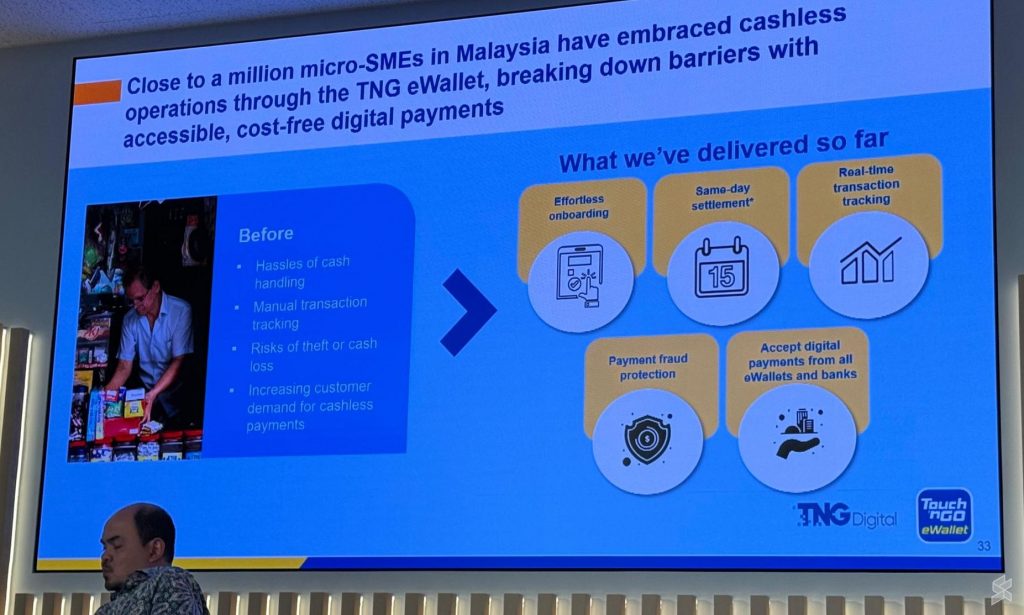

Helping small businesses beyond accepting QR payments

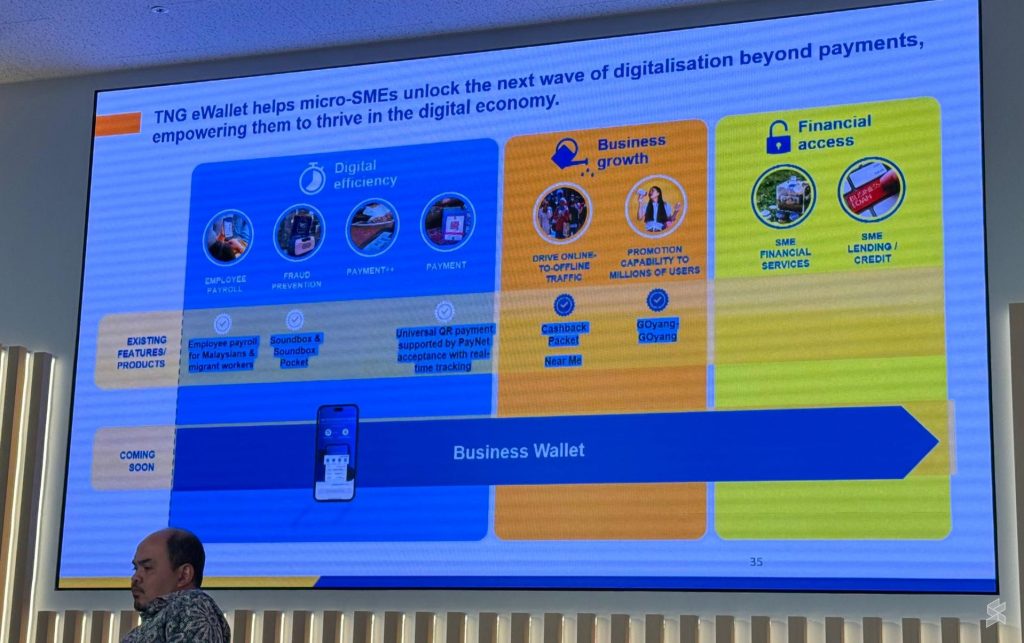

Besides enabling QR payments, TNG eWallet has rolled out a host of tools to help with businesses with day-to-day operations, visibility, and financial access.

The TNG Soundbox gives merchants instant, audible confirmation of payments, reducing the need to check customer screens especially during peak hours. The TNG eWallet Merchant dashboards help businesses track daily transactions and generate real-time insights, replacing manual bookkeeping or expensive POS setups.

To help merchants grow, TNG eWallet has rolled out features such as Cashback Pocket and Near Me to promote online-to-offline traffic.

In addition, TNG eWallet also provides access to SME financial services and micro-lending options, helping smaller players secure working capital.

The eWallet provider has also teased a new Business Wallet which is expected to rollout soon. This business-centric eWallet is expected to provide additional tools including the ability to provide access to staff.

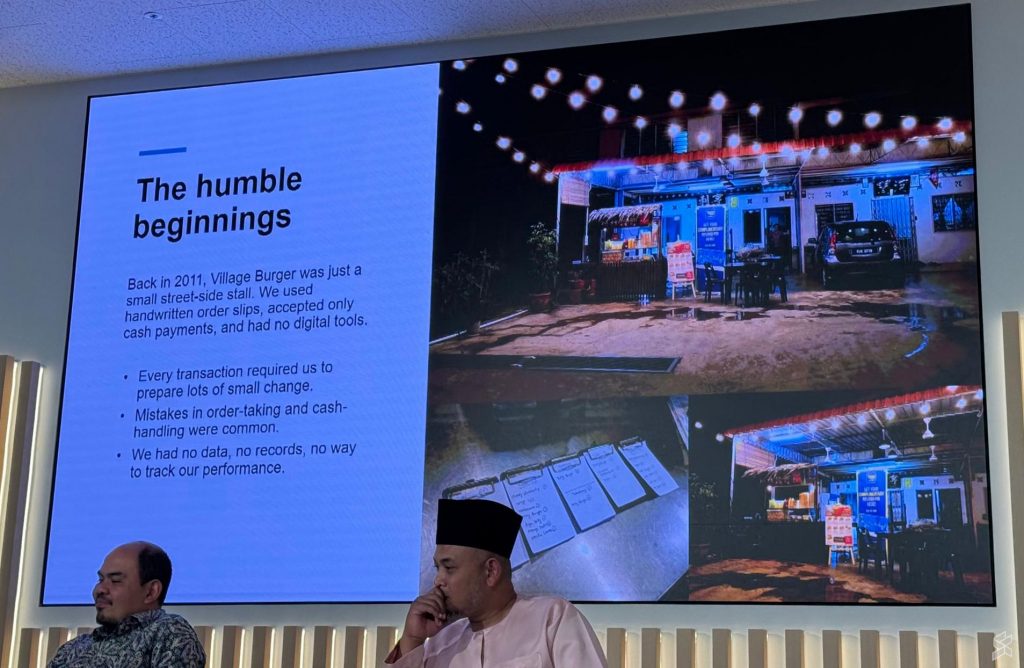

Village Burger: From handwritten slips to digitalised multi-outlet business

A prime example of digital transformation is Village Burger, a F&B business that started in 2011 as a small roadside stall in Penang. At first, orders were manually taken on handwritten slips and payments were strictly cash-only.

Their first step toward digitalisation was adopting an ePOS system, which sped up order taking, reducing errors and enabled automatic receipt generation. This was followed by the adoption of eWallet payments via TNG eWallet.

The shift towards QR payments has brought clear benefits, including reduced cash handling, simplified end-of-day reconciliation, and faster customer turnaround.

Today, Village Burger has expanded to multiple locations and they are also listed on food delivery platforms. The business utilises TNG eWallet’s Merchant Dashboard for live sales tracking and accurate reporting across branches. The use of TNG Soundbox has also been critical to the business as it provides real-time payment alerts and it helps to avoid confusion during busy service periods.

More digitalisation efforts needed for rural areas

Across the board, ePayment usage is growing rapidly in Malaysia and it has already far exceeded the Twelfth Malaysia Plan’s (RMK-12) target to have 15,000 merchants adopting cashless payments by 2025. The average eWallet usage rate in Malaysia is at 64% which is only second to China.

According to BNM’s Annual Report 2024, ePayment transactions per capita increased from 343 in 2023 to 409 in 2024 and eMoney (eWallets) now account for 38% of all ePayment transactions, putting them just 1% behind online banking. Payment cards come in at 22%, while direct debit accounts for just 1%.

The BNM report also stated that the wider DuitNow QR merchant network has contributed to an increase in DuitNow QR transactions by more than double from 360 million in 2023 to 870 million in 2024, with a total transaction value increasing from RM14.6 billion in 2023 to RM31.1 billion in 2024.

Despite strong growth, disparities still exist between urban and rural areas. According to KPDN, the average eWallet usage rate in urban areas is 63.8%, while in rural areas, it is at 36.5%. This highlights a gap that still needs to be addressed which include improving internet connectivity and building trust among small businesses in rural areas.

In one of the shared examples, retailers at Pulau Pangkor were eager to adopt QR payment several years ago but the internet connectivity on the island was very weak. After working closely with the Ministry of Communications and the telcos, the signal strength on the island had improved and they managed to onboard over 90% of retailers to cashless payments through the eWallet partners.

KPDN aims to overcome these adoption challenges through continued advocacy and outreach campaigns in rural areas.