TNG Digital has officially unveiled the new TNG Digital Business Account. Housed within the same Touch ‘n Go eWallet app, the new Business Account is designed to make it easier for small businesses such as SME, micro-SMEs, hawkers, informal merchants, and gig workers to obtain payment settlement services for their daily transactions.

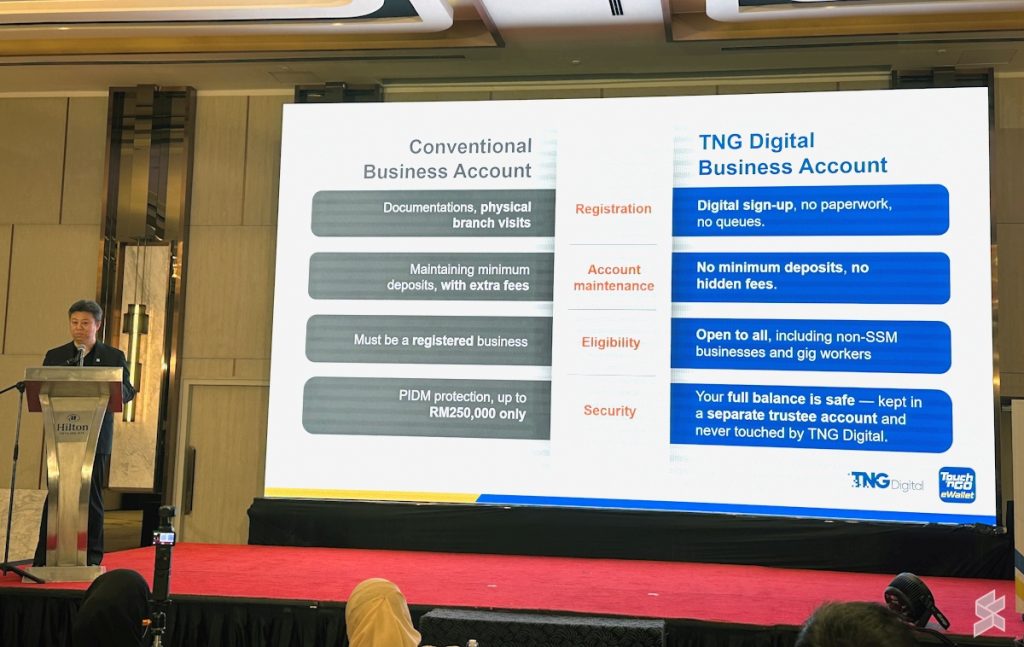

Many of these businesses were not able to obtain such services from traditional banks and merchants due to various reasons. Among the common issues include not having their businesses registered with the Companies Commission of Malaysia (SSM), high barriers to setting up business bank accounts, and many more.

The TNG Digital Business Account offers a streamlined onboarding process that eliminates paperwork through the TNG eWallet app, which TNG Digital claims can be completed within 30 minutes. In addition to that, the company said that there are no additional fees or minimum balance requirements for businesses to utilise the new Business Account.

Isolated from the TNG eWallet individual account, we were told that the TNG Digital Business Account received regulatory approval from Bank Negara Malaysia last year.

TNG Digital Business Account vs existing Merchant account

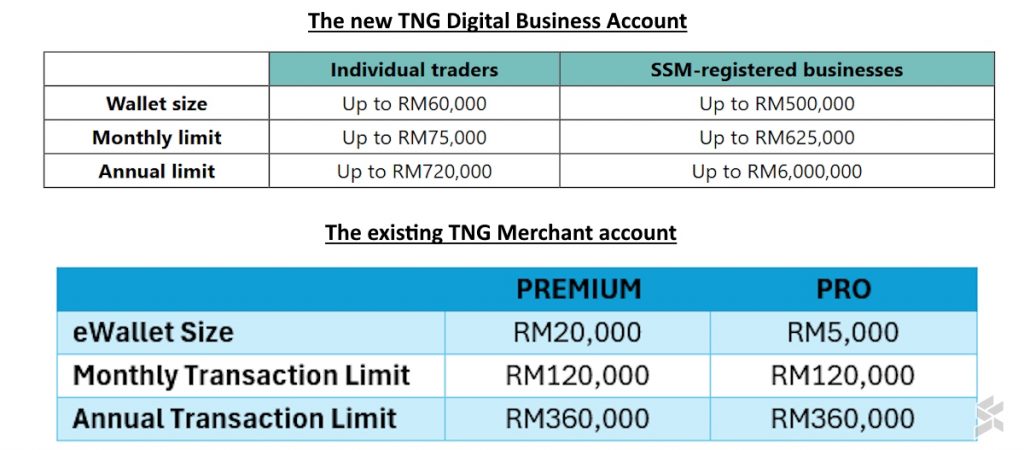

One of the major differences between the new Business Account and the existing Merchant account is their wallet size. At the moment, the Merchant account can only support up to RM5,000 for the Pro account or RM20,000 if you have the Premium account.

With the new Business Account, the wallet for individual traders is RM60,000, while SSM-registered businesses can store up to RM500,000 in their wallet. The same case applies to the monthly and annual transaction limits, too:

TNG Digital has also highlighted quicker settlements as one of the main reasons for businesses to pick up the new Business Account. Under the existing Merchant account, some customers may depend on settlements through banks, which may take some time to be completed, especially during weekends.

Even though the Merchant account does have the settlement to eWallet option, it is only available to individual traders while settlements for SSM-registered businesses have to go through the bank. For the new Business Account, any payment will go directly to the eWallet regardless of the business type, and the business owner can easily transfer that payment to their bank account or personal TNG eWallet via DuitNow.

Other than that, the new Business Account also allows business owners to set read-only access to the business Dashboard for up to 20 staff members. For the Merchant account, owners can allow up to 3 staff members to receive sales alerts.

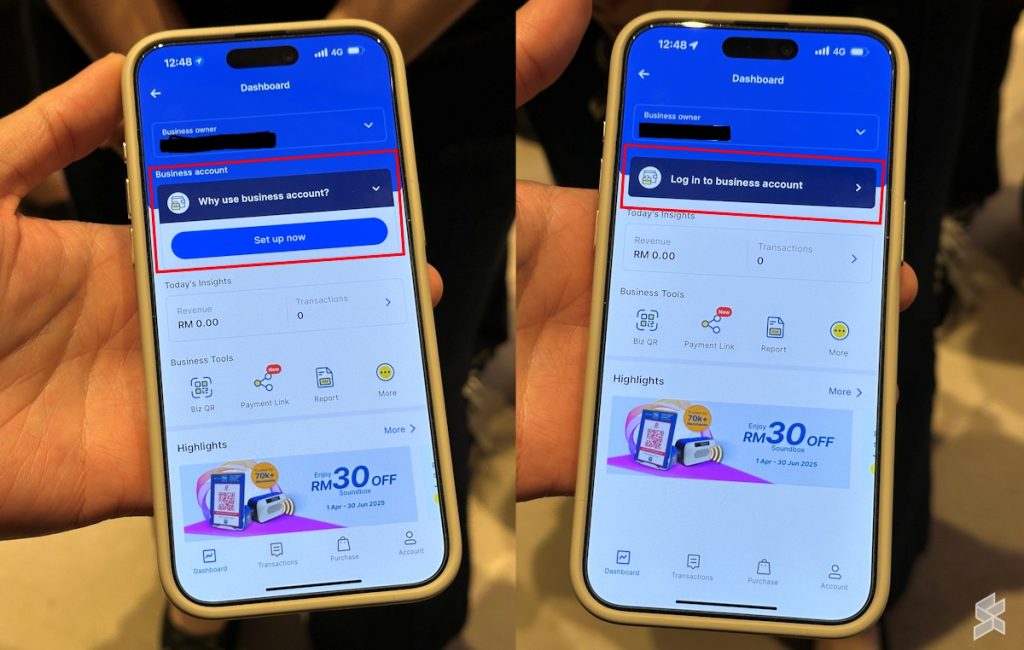

No automatic migration to the new Business Account

Businesses that apply for TNG eWallet’s merchant services from today onwards will be onboarded directly to the new TNG Digital Business Account. Those who are still on the older Merchant account can switch to the new Business Account through the Set Up button on their Dashboard.

Meanwhile, the CEO of TNG Digital, Alan Ni, said during today’s launch event that businesses can look forward to more features from the company very soon. While he didn’t elaborate further, Alan said that these features will help businesses grow their money and ultimately, bring more customers to their doors.