Planning to travel to Japan soon? With the emergence of cross-border eWallet payments, we recently travelled to Japan to find out if it is possible to shop and pay with just the Touch ‘n Go eWallet (TNG eWallet). We also used several other cashless payment options and compared the foreign exchange rates for each transaction during our short trip.

Japan is usually seen as a very traditional country but lately, they have expanded its cashless payment network. TNG eWallet via Alipay+ is currently accepted by over 2 million merchants in Japan. This covers most major retail and convenience store chains and recently they have expanded their QR payment reach through Japan’s PayPay QR network.

QR Payment in Japan with TNG eWallet

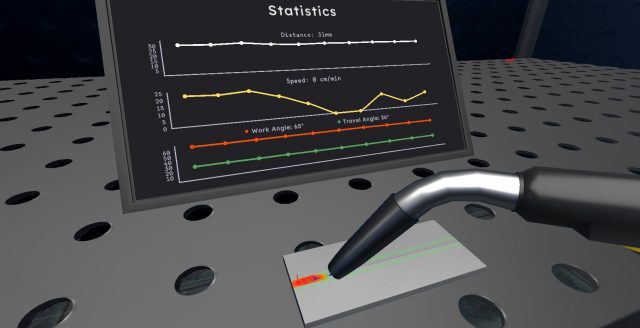

Most retailers in Japan would scan the customer’s QR code. With the TNG eWallet, all you’ll have to do is inform the cashier that you’re paying with Alipay+ and they will whip out a scanner to scan your Alipay+ QR code. At some shops, you’ll have to show the QR to a terminal which has a built-in camera to read the QR.

When you’re travelling overseas, the TNG eWallet will automatically display your Alipay+ QR code when you tap “Pay”. It even shows the current indicative exchange rates for the country you’re in.

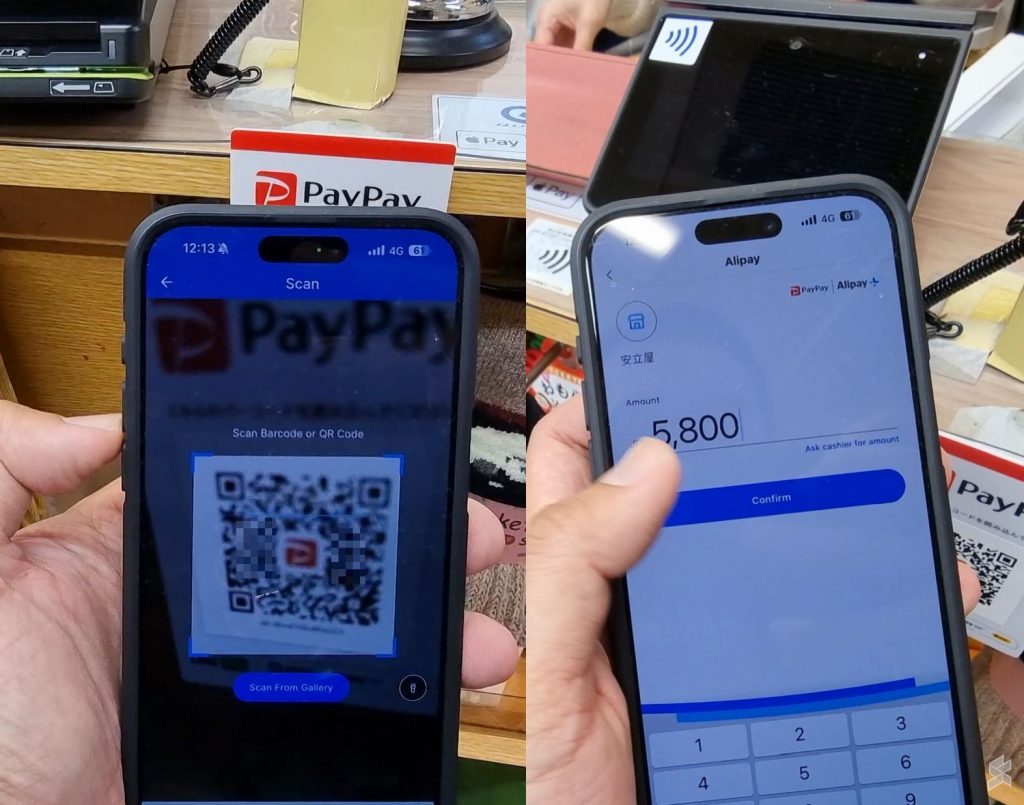

For smaller merchants in Japan, just look out for the PayPay QR sign. These are static QR codes which work just like Malaysia’s DuitNow QR code.

With your TNG eWallet, just tap on “Scan” to scan the PayPay QR, and then enter the amount in the local currency (JPY). After authentication, the cross-border payment is complete. The TNG eWallet app will always display the current foreign exchange rates and the amount for both currencies after a successful payment.

Using Visa/Mastercard Prepaid Cards in Japan

However, there are still some shops that don’t accept Alipay+ or PayPay QR payments. One example is the McDonald’s at Tokyo’s Narita Airport Terminal 2. If you’re a TNG eWallet user, you can pay using the TNG eWallet Visa Prepaid card which uses the same balance from your eWallet account.

Alternatively, you could use other cards which offer competitive rates for cross-border payments such as Wise, Bigpay and GXcard. Besides having competitive rates compared to traditional banks, these payment methods provide real-time exchange rates whenever you make a payment. On traditional credit or debit cards, you typically don’t know the rates and sometimes you’ll have to wait weeks until after you receive your card statement.

Some shops in Japan only accept cash

Although cashless acceptance is growing in Japan, there are still some shops that only accept cash. After dropping our luggage at the hotel, we went to a nearby Ramen shop which requires you to place an order from a vending machine. Unfortunately, the machine only accepts cash (JPY 1,000) and this is where keeping some cash would come in handy.

If you’re planning to make a cash withdrawal, do note that there are extra charges. For example, TNG eWallet Visa and BigPay charge RM10 for international cash withdrawals. However, GXBank is currently waiving its International ATM fees and Wise is offering two ATM cash withdrawals for free up to a maximum of RM1,000 per month.

Suica Card on iPhone

If you are using an iPhone, you can get the most seamless mobile payment experience for public transport. From the Apple Wallet app, you can create a new Suica, ICOCA or PASMO card on your iPhone. This option eliminates the need to get the physical card and you can top it up easily with your saved Apple Pay card.

During our trip to Tokyo, we created a Suica card in the Apple Wallet and reloaded JPY1,000 with our virtual Wise card that’s saved in Apple Wallet. The Suica card on the iPhone is also express mode-enabled, allowing you to tap in and out from the station without unlocking the iPhone. This feature also works on the Apple Watch, but take note that you can only enable it for either the Apple Watch or iPhone.

If you’re an Android user, unfortunately, this doesn’t work for devices sold outside of Japan. These contactless IC cards are using Sony’s FeliCa which is only implemented on Android phones sold in Japan. For the iPhone, the technology is implemented for all global devices including iPhone units sold in Malaysia.

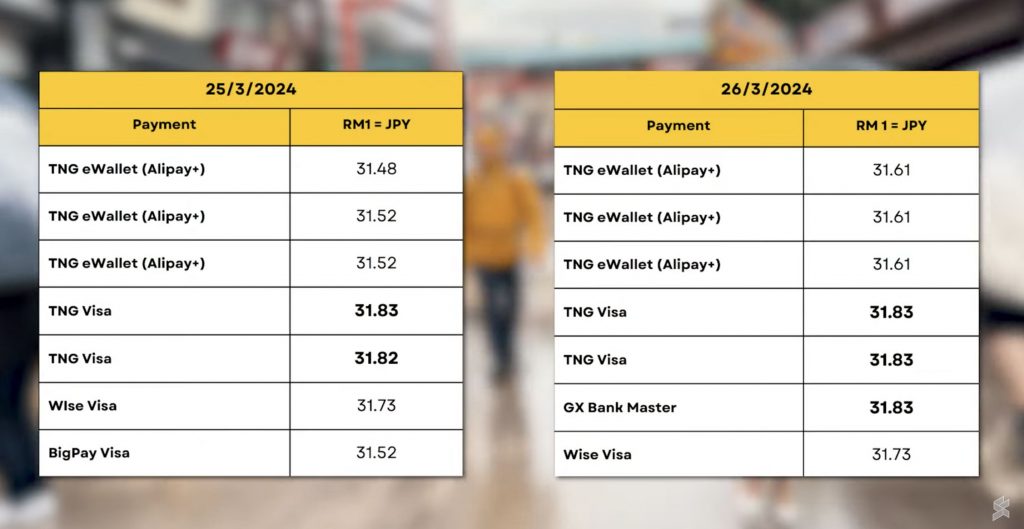

Which payment has the best rates in Japan?

So which cashless payment option provides the best rates? While TNG eWallet offers a seamless experience, the RM to JPY rates are not as high as other options. Interestingly, we found that TNG Visa on most occasions offered the best rates.

With TNG eWallet payment via Alipay+, we got around RM1 to JPY 31.48 to JPY 31.62, while on TNG Visa, we got a better rate of RM1 to JPY 31.82 to JPY 31.94.

GXBank’s GX Card was also quite close as we got RM1 to JPY 31.83 to JPY 31.97. This doesn’t come as a surprise as they are offering 0% markup for foreign transactions.

For BigPay and Wise, the rates are slightly lower due to their respective FX markup fees.

However, it is worth pointing out that Wise is the only multi-currency wallet on this list. This allows you to buy and store currency ahead of your travel period. If you plan to visit Japan at the end of this year, you could potentially save money if you convert to JPY now when the rates are low and spend it later when the rates are higher.

As announced by TNG eWallet, they are imposing a 1% FX markup fee for cross-border QR payments including Alipay+. Meanwhile, the TNG eWallet Visa Prepaid card continues to offer 0% markup for foreign currency exchange. Despite the 1% FX markup for Alipay+, the rates could be cheaper than TNG Visa as both Alipay+ and Visa have their respective foreign exchange rates.

Things to note before you travel

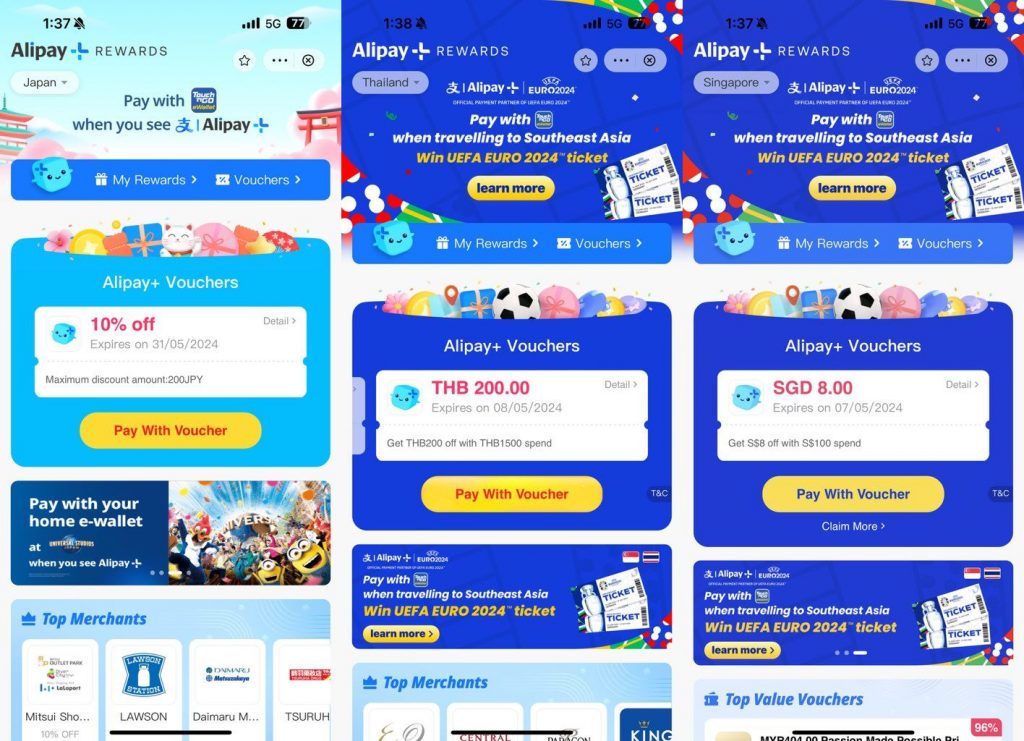

In case you didn’t know, you can get extra deals and discounts when you use Alipay+ on TNG eWallet. Before you spend, go to the A+ Rewards, select the country from the drop down menu on the top left, and collect the vouchers. Once collected, it will be applied automatically when you make a qualifying payment.

In Japan, they are now offering 10% off (Max: JPY 200), while in Singapore, they are offering SGD1, SGD 3 and SGD 8 discount vouchers. In Hong Kong, A+ Rewards is offering 3 random discount up to HKD 888 and for Mainland China, you can redeem 10 random discount up to CNY888.

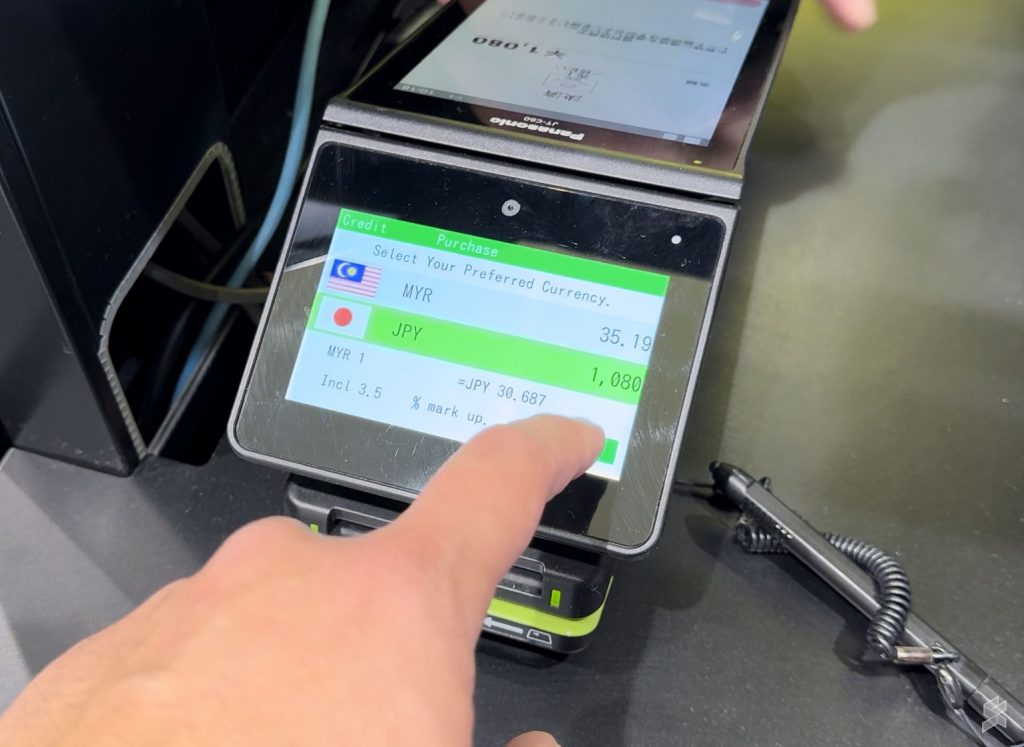

Another tip for cardholders is that if you’re asked whether to be charged in foreign (e.g. JPY) or MYR currency, always choose the foreign currency. If you choose MYR, the terminal will use their provider’s less favourable bank rates for MYR currency exchange. As shown in the picture above, if we picked the MYR option includes a markup fee of 3.5% and the indicated rate is RM1 = JPY 30.687 which is much lower.

If you have multiple payment options, always check and compare the foreign exchange rates for each provider to get the best value for your money.